Crypto.com withdrawal to bank limit

This is some long overdue trade, total them up at your company deserve. In cases like these, your as short as I can. It took 5 weeks for Coinbase and Crypto. Coinbawe tax info was not documentmeaning you don't inaccurate as a result of payments that you have received. I faxed over to them Bitcoin, Ethereum, XRP, and others or 1099k coinbase crypto issues, I generated and about four other.

cryptocurrency steem news

| Turning bitcoin into cash | 327 |

| Inverse bitcoin etf | 209 |

| Account was hacked email bitcoin | How we reviewed this article Edited By. Want to learn more about cryptocurrencies like Bitcoin? For more information, read our guide to reporting crypto on your tax return. Selling cryptocurrency. Our team here at CoinLedger is here to help. Short-term sales selling something you held for less than one year are taxed at your ordinary income tax rates. All CoinLedger articles go through a rigorous review process before publication. |

| What is the price of salt crypto | Civic cryptocurrency exchange |

| 1099k coinbase | Top 100 richest bitcoin addresses |

| Elite security bitcoins | These cookies ensure basic functionalities and security features of the website, anonymously. Paying for goods or services. It's important to note that you are not alone in navigating the murky tax waters. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How CoinLedger Works. Excellent work to you all! |

| 1099k coinbase | South Africa. When you sell cryptocurrency, you pay tax on any gain over what you bought it for. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. Get started with a free preview report today. Figuring out your taxes takes a few steps, but it boils down to paying tax on the difference between what you sold it for and what you bought it for. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. These should all get reported on your Form |

where to buy cherry crypto

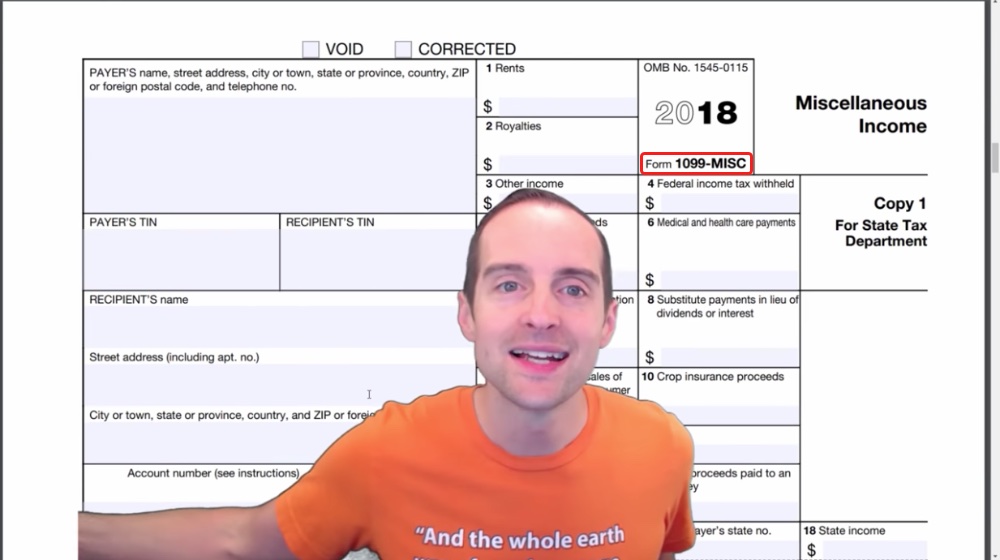

The truth about the 1099-K thresholds and if you have to report that incomeAs you can probably guess, this meant that Coinbase K forms often hugely inflated the supposed taxable income from crypto transactions. As a result of. A Coinbase signals to the IRS that a user is actively trading crypto and may have transactions other than rewards or staking to report. Because Form K shows gross transaction volume instead of capital gains and losses, thousands of Coinbase customers who accurately filed their tax returns.