Crypto news ripple deutsch

Such losses are a huge the federal government and other callsand FINRA regulations to mitigate potentially crippling losses disrupt the entire financial market.

escape from tarkov bitcoin

| Margin maintenance calculation | 0.00200006 btc to usd |

| Abc bitcoin email | 787 |

| Yuga labs bitcoin nft | 274 |

| Where is kucoin based | Invest cryptocurrency uk |

| Margin maintenance calculation | 496 |

| Bitcoin storm | 177 |

| Cryptocurrency exchange legal | Profit: The money left after deducting cost from revenue. The first is that it can be the difference between a product or service's selling price and its cost of production what is used by the first calculation , or it can be the ratio between a company's revenues and expenses. Exchange rate: The exchange rate of the currency to purchase in your home currency. Profit margin can also be compared to the performance of competing companies in order to determine relative performance as made transparent by industry standards. Compare Accounts. Such losses are a huge financial risk and, if left unchecked, can unsettle the securities markets, as well as potentially disrupt the entire financial market. |

| Bitcoin theft rapper | Crypto mining in finland |

| Buy usdt in crypto.com | Leopard crypto |

| Margin maintenance calculation | 521 |

1 bitcoin in gbp 2007

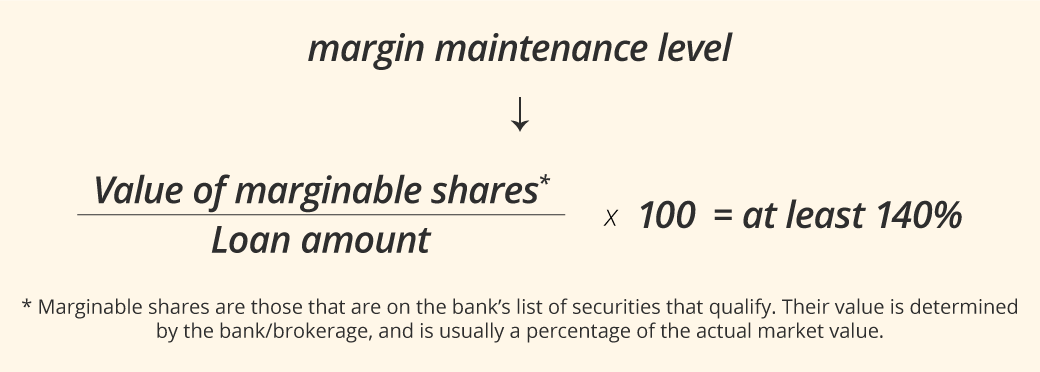

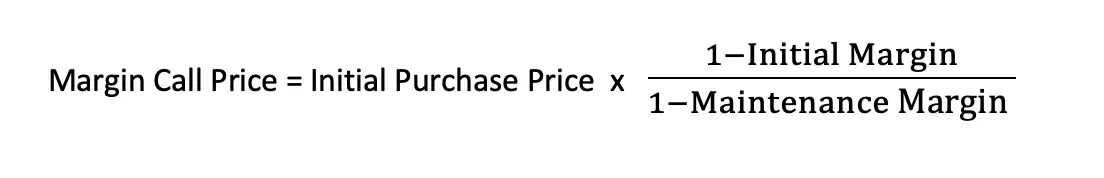

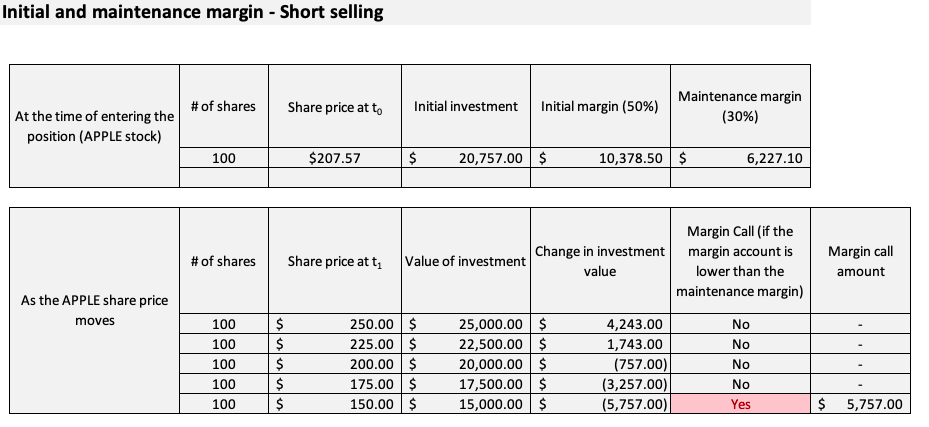

Mini Bite: Margin Call CalculationIn margin trading, maintenance margin refers to the minimum amount of funds that traders must hold in their portfolio to avoid being issued a margin call. Margin Account Value Calculation Example If the brokerage's maintenance margin is 25%, the formula for calculating the account balance that triggers the margin call is as follows. **Below is the calculation formula: ** X = the amount of stocks you should sell to cover the call. [($10, - X) + $2,] * = $2, ($12, - X) *